After that, you enter the Initial Coverage Phase. After your total out-of-pocket costs reach 7,400, you will pay the greater of 4.15 copay for generic (including brand drugs treated as generic), and 10.35 copay for all other drugs, or 5 coinsurance. You will pay the network discounted price for your medications until you have satisfied the deductible. The standard monthly Medicare Part B premium for 2023 is 164.90, which is a decrease of 5.20 from 170.10 in 2022.

#MEDICARE COPAY 2023 FULL#

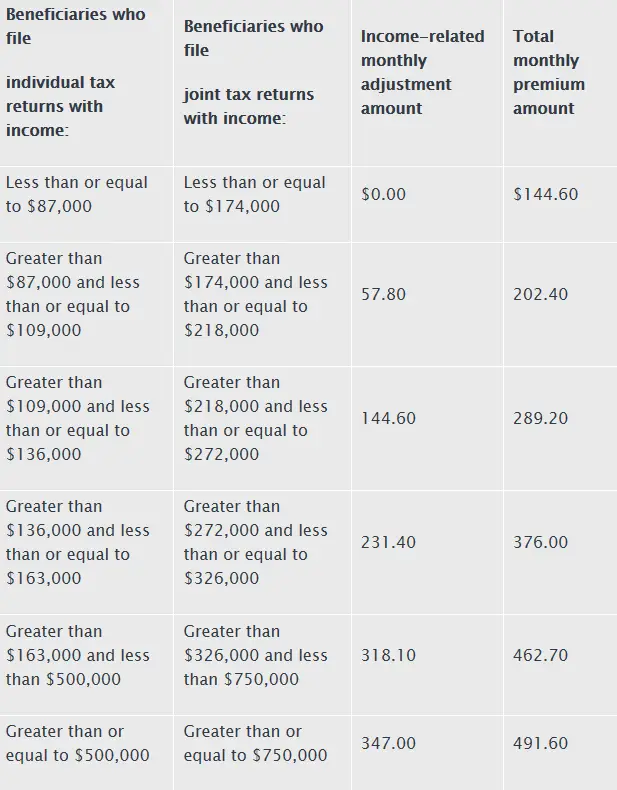

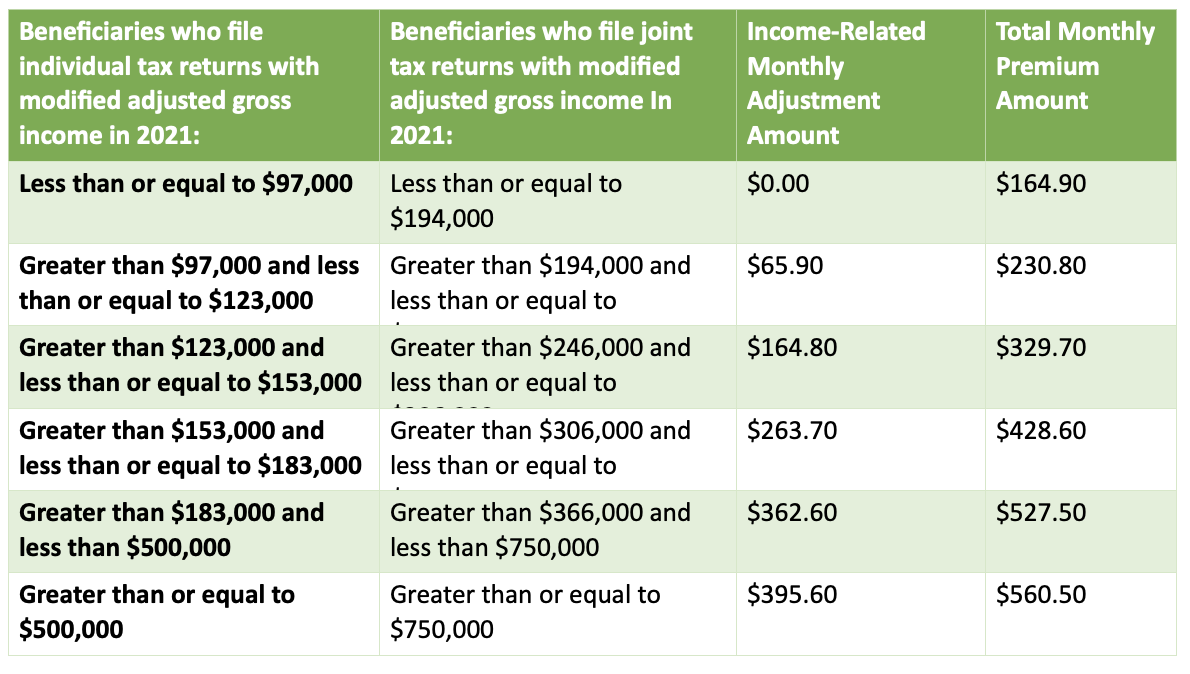

Companies may charge the full deductible, a partial deductible, or waive the deductible entirely. Keep in mind, this is the max deductible amount insurance carriers can charge you. Most people do not pay a monthly Part A premium because they or a spouse have 40 or more quarters of Medicare-covered employment. In 2023, the maximum annual deductible for Part D plans is $505. Beginning in 2023, insulin copays will be capped at 35 per month, as a result of a change in federal law. Below is a chart that will tell you the extra amount that Medicare will add to your Part D plan premium based on your income. Just like with Part B of Medicare, in 2023, if you make over $97,000 as an individual or over $194,000 if you file your taxes jointly then you will pay an Income Related Monthly Adjustment Amount also called an IRMAA. If you have a high income you may pay an extra amount on top of your standard plan premium. Medicare Premiums, Deductibles, Co-Insurance 2023 1,600 deductible for each benefit period Days 1-60: 0 co-insurance for each benefit period Days 61-90. Most plans vary from $10 – $100 depending on the factors mentioned previously, but the projected national average monthly premium in 2023 is $34.71 for a Part D drug plan (according to cms.gov) 0 copayment per day for all other days of a Medicare- covered stay in a hospital, for each admission. Since the monthly Part D premium is set by the individual insurance company, premiums will vary based on several different factors including the insurance carrier, where you live, the drug formulary, etc. While the average cost of Medicare Advantage is projected to be 18 per month in 2023, the amount you end up paying can vary quite a bit. If you are enrolled in an Medicare Advantage Plan, or a Medicare Cost Plan that includes Medicare prescription drug coverage, your prescription drug coverage will most likely be included in your monthly premium, and in some Part C plans, there will not be a premium. Some also purchase a supplement plan - aka "Medigap" - which picks up some of the costs that come with basic Medicare, such as coinsurance or copays.Mos t Medicare Part D plans charge a monthly premium that varies by plan carrier. Many beneficiaries stick with basic Medicare and often pair it with a standalone Part D plan. Do you know your rights to nursing home coverage under Medicare Medicare Part A pays. In 2023, the Medicare Part A deductible is 1,600 per benefit period, and the Medicare Part B deductible is 226 per year. On the other hand, higher-income beneficiaries pay more for certain parts of coverage (more on that farther down).īasic Medicare consists of Part A (hospital coverage) and Part B (outpatient care). Days 21 - 100: patient pays 194.50 coinsurance is 200 per day in 2023. Beneficiaries with limited income may qualify for Medicaid or other programs that help defray out-of-pocket costs. In 2023, the Inflation Reduction Act (IRA) introduces an insulin cost-saving provision - similar to the existing Senior Savings Model (SSM) - with coverage for all formulary insulin at a 35 (or less) monthly copay throughout all phases of Medicare Part D plan coverage (up to the 2023 Catastrophic Coverage phase where you will pay only 5 of the.

And, of course, how often you use the health-care system can contribute to your costs. Overall, your coverage choices impact how much you pay in premiums, deductibles and copays or coinsurance.

#MEDICARE COPAY 2023 HOW TO#

More from Personal Finance: Here's what Secure 2.0 means for near-retirees 5 tips to tackle holiday-induced credit card debt How to maximize tax breaks for charitable gifts "It's important to always review the Medicare figures that are changing, so you can budget accordingly," said Danielle Roberts, co-founder of insurance firm Boomer Benefits. Personal Loans for 670 Credit Score or Lower Personal Loans for 580 Credit Score or Lower Best Debt Consolidation Loans for Bad Credit

0 kommentar(er)

0 kommentar(er)